The growing complexity of the banking and financial services industry highlights the need for high-quality software testing. This guide provides an overview of software testing procedures in the banking domain by covering what types of tests are typically used, how to create effective test cases, and what challenges you may face.

How to test banking applications?

Software testing plays a crucial role in the creation of applications for the banking and finance sector. By conducting tests during the development stage, developers can detect any defects early on and address them promptly, preventing potential major problems. Additionally, banking software testing ensure that applications meet security, reliability, and scalability requirements.

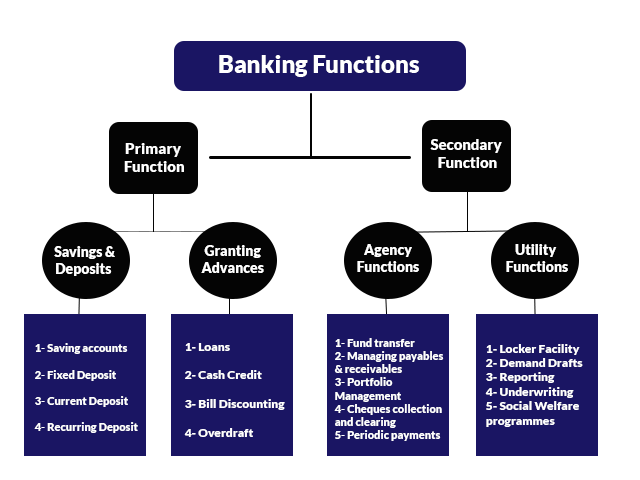

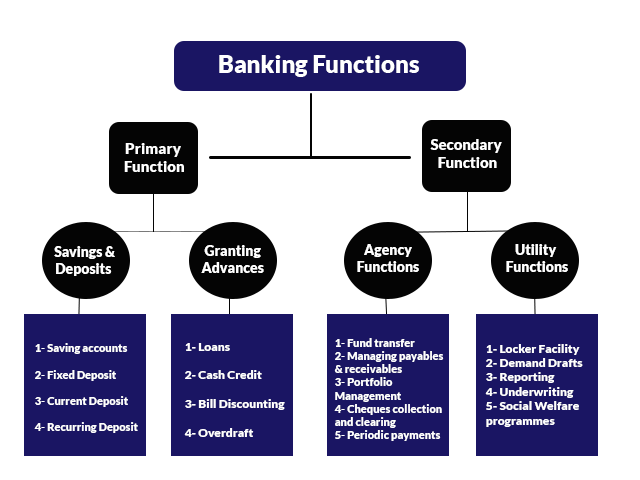

Functions performed by Banking Applications

Banking applications are software solutions that help financial institutions manage their services and transactions. Therefore, they must be reliable, secure, and able to handle high volumes of data. Also, typical banking application functions include money transfers, mobile banking, online banking, loan processing, payment gateways, ATM transactions, customer accounts management, fraud detection, asset management, and more.

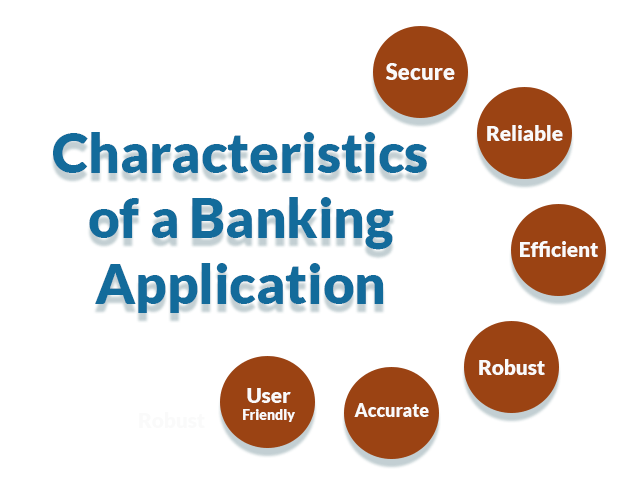

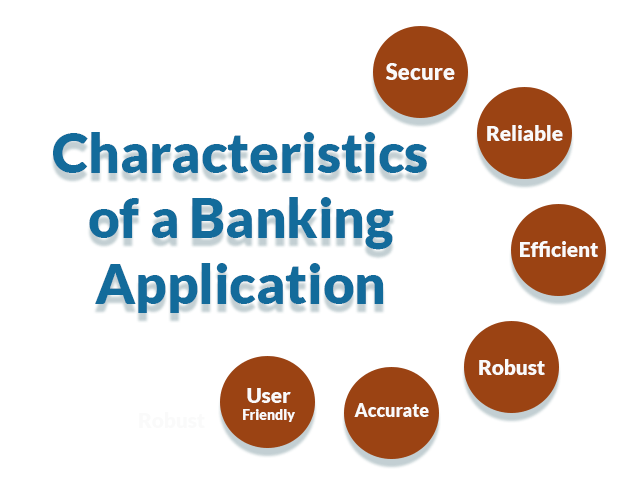

Characteristics of a Banking Application

- Banking Apps must be secure, reliable, and efficient

- Multi-tiered system for supporting thousands of concurrent users.

- Must be able to process large volumes of data and provide accurate results promptly.

- User authentication, encryption, data integrity checks, transaction logging features, and more.

- Robust audit for troubleshooting customer issues.

- Handle complex business workflows and different transactions, such as deposits and transfers.

- Scalability options so that customers can use them across various banking channels, including web-based banking, mobile banking, and ATMs.

- Real-Time and batch processing

- Provides detailed reporting system to keep track of day-to-day transactions.

What makes banking software so complicated?

- The complexity of banking software is attributed to the high volume of data it processes and the strict security measures it must adhere to.

- The strict regulatory and compliance requirements also make testing banking applications more challenging.

- The integration of multiple systems across different environments poses a challenge in ensuring the seamless operation of all parts of the banking software.

- To meet the 24/7 high-performance demands, software testing in banking must prioritize reliability, scalability, performance, and functional accuracy.

- The incorporation of new technologies further adds to the complexity as the testing process must be flexible enough to adapt to changing requirements.

Importance of Banking Application Testing

Any modern financial system relies on essential Banking Apps that give users control over their accounts. Users can track their transactions, transfer money, pay bills, and manage investments through these applications. To safeguard user data from malicious hackers, these apps feature robust security measures. As digital banking services expand globally, software testing increasingly becomes an important part of building and maintaining banking software.

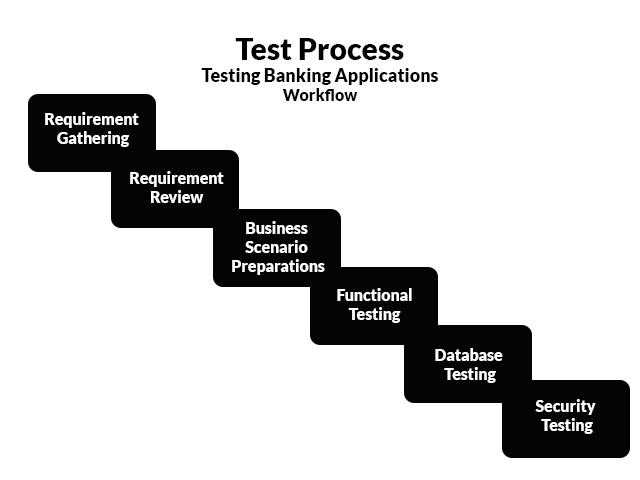

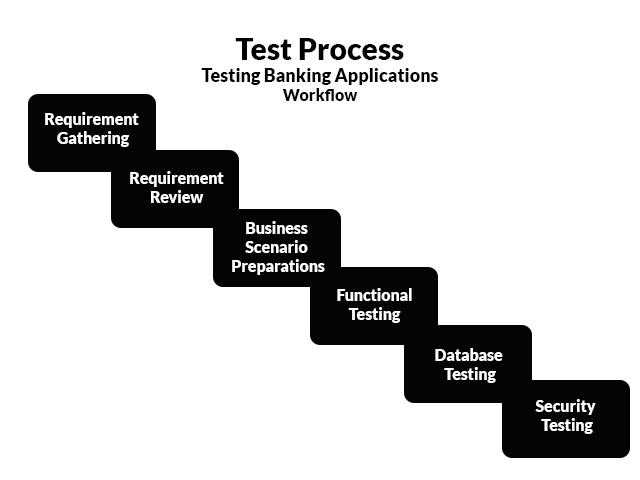

Testing Banking Applications: Test Process

The testing process for banking applications follows a structured workflow. The steps are as follows:

Requirement Collection

Establishing a comprehensive set of requirements for the banking application is essential. It will include both functional and non-functional requirements, as well as potential user scenarios. The requirement-collection process should also identify areas that need special attention during the test development phase.

Requirement Evaluation

Upon collection of the requirements, they should be evaluated by a team of experts (QA Engineers, Development leads, and Peer Business Analysts) to ensure accuracy. This review process helps identify gaps and conflicts between the requirements and the actual functionality of the banking application.

Business Scenario Preparations

It is essential to develop business scenarios based on the requirements that Business Analysts review. As a result, it will develop test cases to verify the banking application’s functionality. The Business Scenario is a high-level scenario without any detailed steps. Business scenarios should also consider potential user errors, security threats, and data integrity challenges.

Functional Testing

Functional testing is validating that a banking application meets the functional requirements. It includes verifying that all features are working as expected and that each feature behaves following user expectations. Functional tests should be comprehensive, covering the main functionality, boundary conditions, negative scenarios, and performance characteristics.

At this point, functional testing is carried out alongside the standard testing procedures:

Test Case Preparation

This stage involves developing Test Cases based on Business Scenarios. There are several positive and negative test cases that result from one Business Scenario. Therefore, creating comprehensive and well-structured test cases that cover all aspects of the banking application is a key element for successful software testing.

Test Case Review

Peer reviews by quality assurance engineers

Test Case Implementation

Finally, the testing process involves executing test cases. This should be done in multiple environments and include various tools to ensure all scenarios are covered. It could be manual or automatic using QC, QTP, etc. It is essential for software testers to document their findings, as this will help identify areas for improvement and inform future updates.

Database Testing

In addition to functional and system tests, database testing is integral to testing for these applications. The banking application contains complex transactions at both the user interface and database levels; therefore, it requires extensive database technology. This test verifies data integrity and accuracy within the banking application’s database. It includes validating that all storage and retrieval of data is accurate.

Database Testing Techniques

- Data loading

- Database Migration

- Data Integrity

- Testing DB Schema and Datatypes

- Testing Stored Procedures and Functions

- Testing Triggers

- Rules Testing

- Performance Testing

- Security Testing

- Database Queries

- SQL Scripts

Database testing aims to ensure the accuracy, integrity, and performance of the data stored in the banking application’s database. Additionally, it ensures committed and reverted transactions are recovered after a transaction has been completed. As a result, it helps prevent data loss or corruption and improves system performance. Furthermore, this type of testing is essential for compliance with regulatory requirements. Data and underlying tables are only accessible to authorized applications and users.

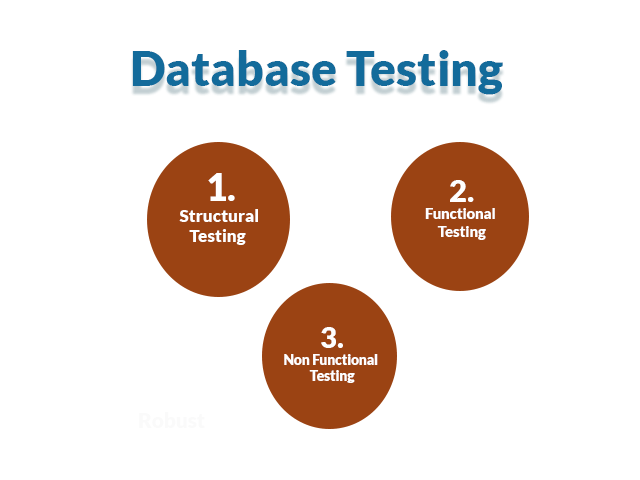

Three ways of Database Testing

Structural Testing

Structural testing involves the analysis of the database schema and associated elements. It includes validating the tables, columns, data type mappings, primary and foreign keys, constraints, stored procedures, etc.

Functional Testing

Testing involves ensuring that the databases meet the needs of users. As part of that process, it is necessary to verify that the database supports the expected business processes and functions. Two methods can be used white box testing and black box testing.

Non-Functional Testing

Load testing, stress testing, and performance optimization1 are all part of the process. Load testing ensures the system can handle a certain number of concurrent users. Stress testing allows developers to identify application areas prone to failure under high usage levels. Finally, performance optimization helps tune and optimize the database for better response time.

Security Testing

Security is of utmost importance when it comes to banking applications. It helps to identify potential security vulnerabilities in software and ensure that only authorized users can access the system. Testers must understand the system’s architecture, components, and configurations to conduct security testing. In addition, test cases should focus on identifying weaknesses in the system’s authentication and authorization processes, encryption algorithms, and password policies.

A security test ensures that the application is secure from external threats and protects it from malicious attacks. Additionally, it verifies if an application adheres to industry-standard security protocols and does not divulge sensitive financial data.

Common types of Security Testing

Common types of security tests include penetration testing, vulnerability scanning, fuzzing, and static analysis.

Penetration Testing: Penetration testing is a simulated attack to identify security vulnerabilities in an application. It involves analyzing the application’s code, network infrastructure, and data storage for potential weaknesses that malicious actors could exploit. The purpose of penetration testing is to find flaws, assess the risk posed by these weaknesses, and recommend mitigation strategies.

Vulnerability Scanning: Vulnerability scanning is a type of automated security assessment that can identify known weaknesses in an application or system. It utilizes specialized software to scan the code and infrastructure of the application, looking for potential vulnerabilities such as outdated libraries and insecure configurations. The results of the scans are used to prioritize remediation efforts.

Fuzzing: Fuzzing is a type of security test that involves feeding random or unexpected data into an application to identify potential flaws. The tester can uncover bugs and buffer overflow that attackers could exploit by injecting invalid input.

Static Analysis: Static analysis is an automated process to examine source code for potential vulnerabilities. It uses specialized software to analyze the code and look for errors, such as improper input validation or logic flaws. Static analysis makes it possible to identify potential security risks early in the development process before they become a problem.

By taking proactive measures to identify and remediate potential vulnerabilities, you can help protect your customers’ data and maintain the integrity of your application.

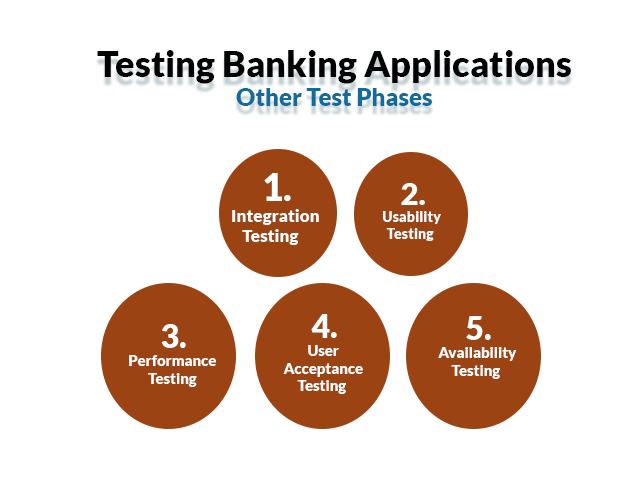

Testing Banking Applications: Other Test Phases

Integration Testing

Integration testing verifies expected data flow between different modules and subsystems. It ensures the proper interaction between the various components of a banking application. Integration testing is critical to verify that the user interface operates correctly and database records transactions accurately.

Usability Testing

Usability testing actively evaluates the user experience of a banking application by testing its intuitive and ease of use of features and functions for customers. During tests, it may require users to complete tasks quickly, such as filling out a form or making a payment. Furthermore, usability tests can determine compatibility with various devices, operating systems, and browsers.

Performance Testing

Banking Applications are tested for performance under normal and peak workloads. Testing includes determining how fast pages and forms load and the process of fast transactions. In addition, performance testing identifies potential bottlenecks in the system that may negatively affect customer satisfaction.

User Acceptance Testing

During UAT, real users test the system in an environment that mimics production use cases. Tests ensure that the system meets the user’s expectations and is free of bugs or errors. UAT tests can include validation of UI elements, transaction processing, data accuracy, and other critical areas of banking application performance.

Availability Testing

Availability testing ensures that the application and database are always available to users, even in cases where there may be maintenance or other system disruptions. It assesses the availability of physical components such as servers and networks.

Challenges in testing the Banking domain & their Mitigation

| CHALLENGES | MITIGATION |

| The complexity of the banking domain. This leads to a large number of potential testing scenarios, which can be time-consuming and resource-intensive to execute manually. | Automating tests simplifies complexity and ensures consistent execution. It enables fast execution of multiple tests to confirm the proper functioning of the banking app. |

| Banking systems process large volumes of data, and testing these systems requires the ability to generate and manage vast amounts of test data. | Testers must have sufficient knowledge of the banking domain and related testing processes to effectively test a banking application. |

| Providing secure environments to its customers is the biggest challenge and requirement of a banking application to protect confidential information regarding money from thefts and hackers. | Security testing should be implemented effectively, and different security layers should be checked. Make sure that test data comply with regulatory guidelines and requirements. |

| Testing all the routines, procedures, and plans can be challenging when migrating a banking system from an old one to a new one. | Ensure Data Migration Testing is complete, execute Regression Tests on old and new systems, and verify the results. |

| Testing the banking application at speed and scale with fewer resources is a challenge. | Data masking or data obfuscation can be used to create synthetic production data. |

| Ensure the system follows the desired policies and procedures before implementing it | Compliance or regulatory policy test must be conducted. |

| The scope and timelines increase when integrating banking applications with other applications, such as online or mobile banking. | Make sure integration testing is included in the time budget for your banking application if it has many external interfaces. |

| Various devices, such as mobile banking, internet banking, and physical banks, must be synchronized. | Testers should conduct performance testing to ensure that it is done correctly. |

Essential Steps to Improve the Banking Application Test Results

- Regularly test the banking domain applications to ensure that your application performs as expected.

- Get involved in typical software testing processes, including collecting requirements, evaluating them, and creating test scenarios.

- Use both manual and automated testing techniques.

- Create an environment to test the app with different parameters

- Use performance and security testing tools to ensure the secure operation of your banking applications.

- Include analytics and reporting features in your banking application for analysis and further optimization.

- Adopt an Agile methodology for continuous integration and delivery of a banking application.

- It is recommended to use real devices when testing since emulators cannot replace actual mobile devices.

- Getting reliable results requires interacting with real users

- Assess your app’s performance and make improvements based on feedback

Sample Test Cases For Banking Application

Test cases for New Branch

- Create a new branch and include both accurate and inaccurate test inputs.

- Create a new branch with an empty state.

- Create a new branch based on an existing branch.

- Check the options for resetting and voiding.

- Update branch information using data from an existing branch.

- Verify whether you can save the new branch.

- Validate the availability of the option to void.

- Investigate the deletion of the branch with and without any linked components.

- Determine if the branch search option is available.

Test Cases for New Role

- Create a new role and include both accurate and inaccurate test inputs.

- Assess the options for resetting, canceling, and saving changes.

- Verify whether you can add a role to an existing user.

- Confirm if it’s possible to add a role to an existing user.

- Verify role deletion with and without dependency.

- Check if the search option works correctly for role creation.

- Check the role definitions and types.

- Examine the links on the role information page.

- Make certain to prevent the creation of repeated roles.

- Inspect the access limitations for each role.

- Guarantee the deletion of roles when no users are referencing them.

- For the administrator role, thoroughly examine all the home links.

- Confirm that the administrator has logged out successfully.

Test Cases for New Users

- Establish a new user by incorporating both accurate and inaccurate test information.

- Create a new user with an empty state.

- Create a new user with existing branch test data.

- Confirm that the user has been added to the system.

- Determine if the options to reset and void work correctly.

- Verify that the password is verified accurately during new user creation.

- Examine the password robustness and verify that an invalid password is not accepted.

- Inspect the system for duplicate users.

- Investigate if all user information fields are functioning properly.

- Evaluate each new account by logging in to ensure its proper operation.

- Guarantee that the new user is displayed in the system with accurate details.

- Verify whether you remove users with dependent roles.

- Examine the required input specifications.

- Inspect the optional input specifications.

- Determine if a user can be created without the optional parameters.

Test cases for Customers and Banker

- Confirm if all links for visitors and customers are functioning correctly.

- Validate the customer’s log-in procedure using both accurate and inaccurate test data.

- Validate the customer’s log-in procedure when no information is provided.

- Confirm that the customer’s account has been added to the system efficiently.

- Verify that customers can access their accounts from different locations and devices.

- Examine the functionality of all links on the customer’s home page.

- Assess banking operations such as deposits, withdrawals, transfers, etc., for both customers and bankers.

- Ensure that all linkages for visitors and clients are functioning properly.

- Verify the client’s log-in process when no data is present.

- Examine the banker’s log-in without giving any information.

- Validate the banker’s login using accurate or inaccurate test data.

- Determine if the client or banker was able to log out successfully.

- Guarantee the security of customer information by testing the encryption methods used in the database.

- Evaluate the security of customers’ payments through the banking application.

Test cases for the creation of a New Account

- Establish a new account by inputting both valid and invalid user data.

- Confirm that there are no duplicate accounts in the system.

- Verify the ability to modify user information.

- Validate if a new user can be saved.

- Validate account creation without any data provided.

- Confirm that the new account can be saved with accurate information.

- Verify if the user can deposit funds into the new account and update the balance.

- Check if the user can withdraw funds from the new account (after the deposit and balance update).

- Confirm that the primary account number is available for secondary accounts.

- Check if data is successfully encrypted when entering and retrieving from the database.

- Examine the links on the account information page.

- Inspect the different account options available in the system.

- Check the balance of the salary account to see if a zero balance can be maintained.

- Confirm the maintenance of a zero or minimum balance for non-salary accounts.

- Ensure that all accounts with dependent roles and users are deleted.

- Validate proof of joint accounts.

- Verify that customers can access their accounts from different locations and devices.

- Verify successful logout by the new user.

Test Cases for Net Banking Application

- Verify the functionality of the page by testing valid and invalid credentials.

- Examine user’s ability to add a beneficiary with accurate and inaccurate information.

- Verify that attempting to log in with an empty username or password displays an error message.

- Confirm that repeated failed login attempts result in a blocked account and an error message appears.

- Investigate the option for the user to change the password.

- Test the search and reset features.

- Assess the proper operation of all homepage links.

- Validate that users can open new accounts, perform transactions, and carry out other banking activities through the application.

- Confirm that users can complete transactions with newly added beneficiary.

- Ensure both the user and recipient’s accounts are updated after transactions.

- Check that customers can view their account statements.

- Check that a confirmation request from the user precedes any transaction.

- Investigate if users can transfer money between multiple accounts.

- Verify that transactions provide a confirmation receipt.

- Test the ability to download documents from customer accounts.

- Validate the security of changes to account details such as email, phone number, and address.

- Examine all banking activities including transfers, payments, balance checks, etc.

- Confirm the ability to print reports and statements from the net banking application.

- Check if the customer can log out successfully.

- Ensure data encryption during database entry and retrieval.

- Validate the implementation of session timeout in case of inactivity.

- Investigate the ability to complete transactions without a minimum balance requirement.

- Examine the error message display for transactions with insufficient funds.

- Validate user’s ability to enter decimal amounts.

- Confirm the amount field does not accept negative numbers.

- Check the functionality of opening a new RD.

- Verify secure access to customer accounts from different locations and devices.

- Examine any discrepancies in transactions such as funds transfers and investments, etc.

Conclusion

Software testing in the banking domain is a critical process to ensure the reliability and security of banking applications. Following the best practices outlined in this guide, you can create test cases that cover all aspects of your banking software application. Ensuring it meets the highest quality standards. In addition, testing processes ensure that customers a have peace of mind knowing their financial information is secure and their transactions are completed as expected.

By utilizing the right software testing tools, banking organizations can reduce costly errors and maintain a high level of quality assurance. With the help of effective software testing, banking companies can ensure that their applications meet customer expectations and remain competitive in the financial services industry.